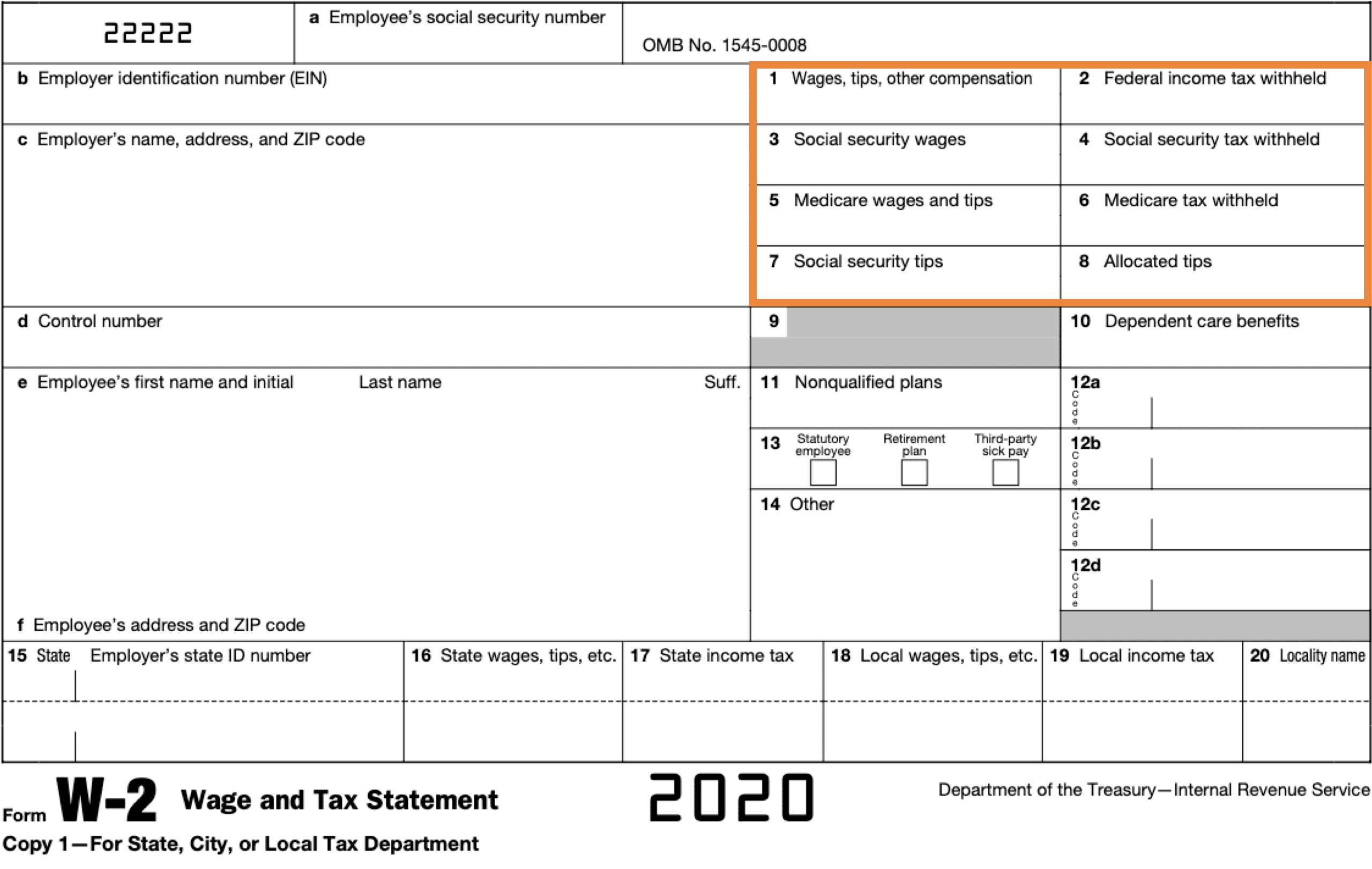

Personal Auto Use On W2. Your employer can figure and report either the actual value of your personal use of the car or the value of the car as if you used it only for personal purposes. Pucc is a non cash fringe benefit that counts as part of your employee's.

He drives 1,000 personal miles in 2018. Every employee provided a company vehicle must make a representation regarding personal use. I will not operate an automobile while impaired, whether due to alcohol, drugs (prescription or nonprescription), lack of sleep, or distraction of any kind.

To get the fair market value of joe’s personal use, multiply his personal miles by 54.5¢ which was the rate for 2018.

It is time to use things for your personal benefit for a. Every employee who has use of an employer owned car must report the personal use of the vehicle to the employer to be added to their w2 as taxable income. Employee representation regarding use of company vehicle. Using the personal vehicle for work law involves using your car for business purposes may be to get supplies, hardware, or prospecting.