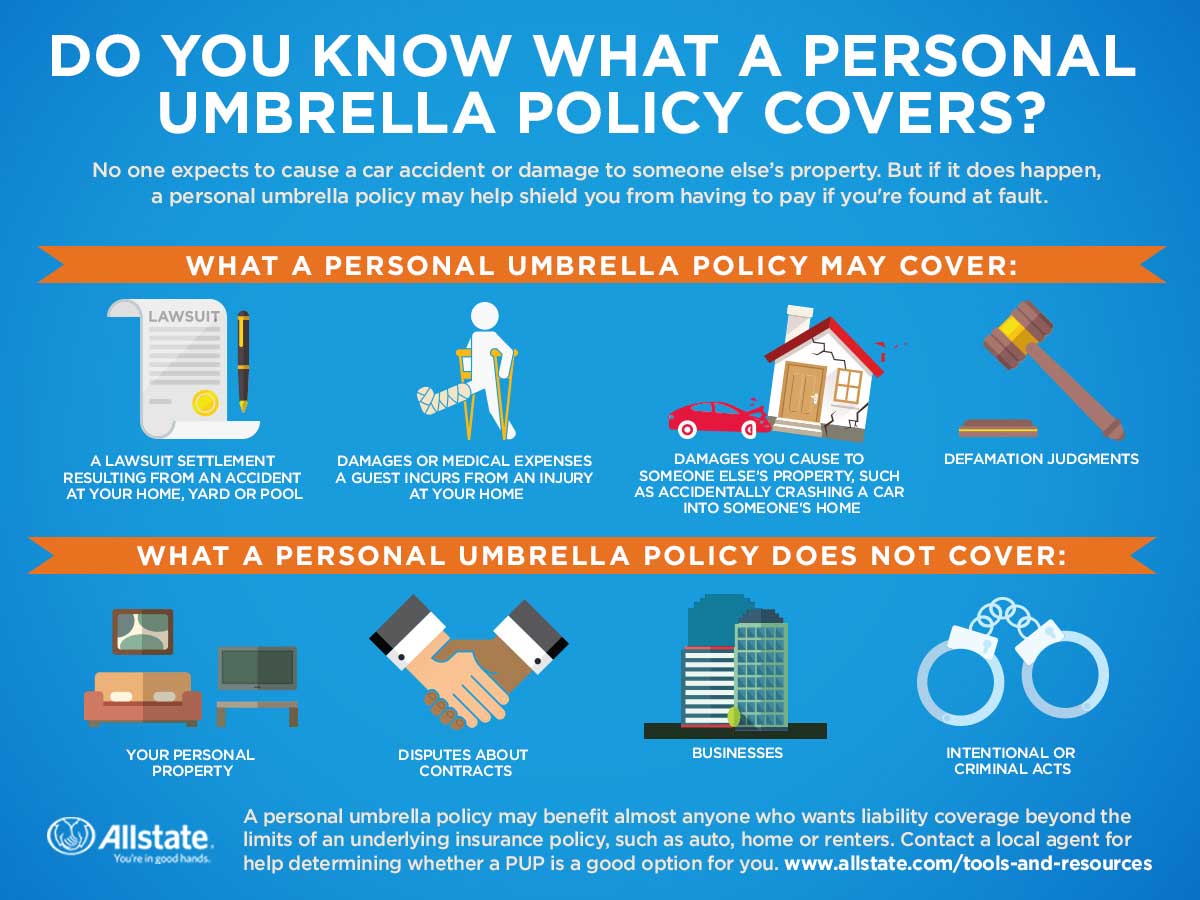

Personal Auto Umbrella Policy. With limits ranging from $1 million to $5 million, it can complete your package of insurance protection. This policy covers bodily injury, property damage, and personal injury, which includes offenses such as libel, slander, false arrest, invasion of privacy, and others.

A personal umbrella applies after the liability limits on the insured's homeowners, personal auto, and boat policies have been reduced or exhausted. The cost of an umbrella policy could be as low as $200 per year, with an average cost of about $380 for $1 million of coverage, according to trusted choice, a network of. Your auto policy has a limit of $500,000 so that leaves you $1,000,000 short.

Umbrella insurance provides additional liability coverage above your existing home or auto insurance policy.

A company will likely mandate minimum liability coverage of $300,000 (or even $500,000) for homeowners and $250,000 per person/$500,000 per accident for bodily injury for. We’re here to help you get the coverage you need and answer your questions about getting a personal umbrella insurance policy. Your independent agent is there to help you. The cost of an umbrella policy could be as low as $200 per year, with an average cost of about $380 for $1 million of coverage, according to trusted choice, a network of.